Flexible repayment options to suit you.

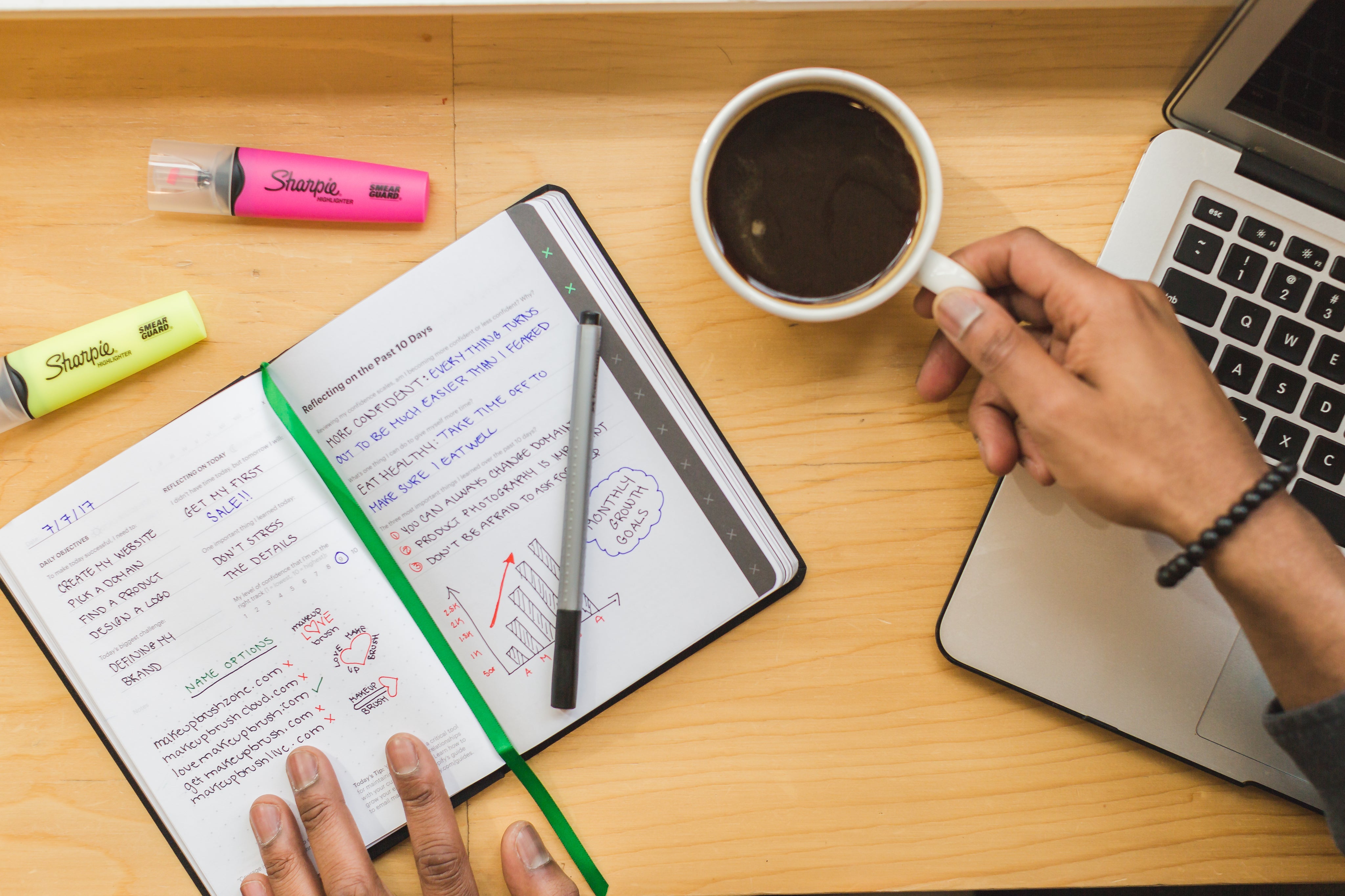

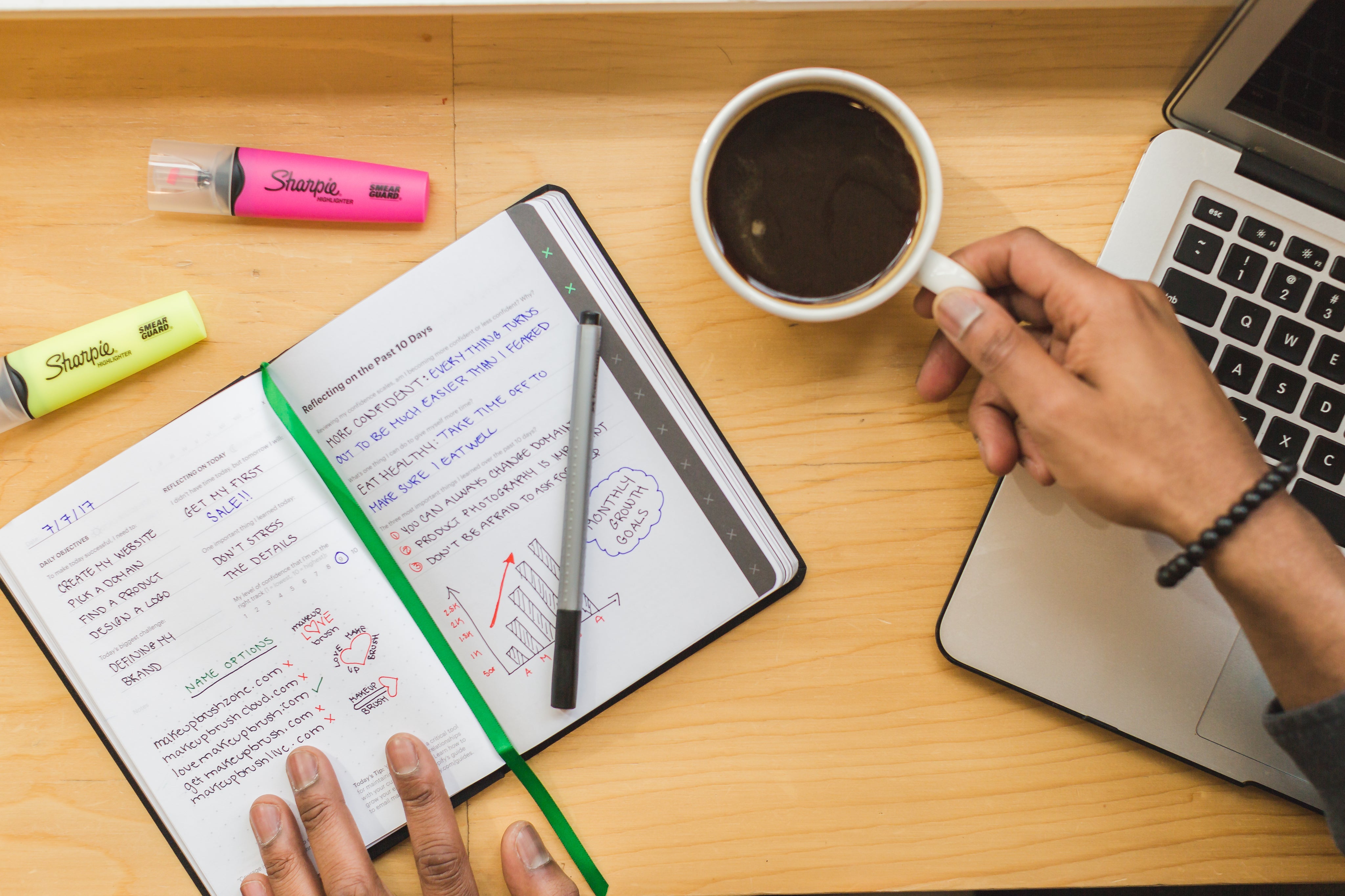

SEE IT. WANT IT. SNAP IT.

- Flexible repayment options available. Choose weekly, fortnightly, every four weeks or monthly

- Representative Example: Cost of Goods £1200, Deposit £50, Amount of Credit £1,150, Annual Fixed Interest Rate 34.04%, Monthly Payment £51.75, Term 36 months, Total Payable £1913.00, Representative 39.9% APR.

Snap Finance helps you spread the cost

When you qualify for Snap Finance, you can choose to pay your balance off in 4 months, over the full term, or call up and make early repayments. Whether you spread the cost over 4 or 36 months, you're in control.

Pay in 4 - Should you pay off your balance in 4 months, Snap will cancel any interest you owe.*

*Interest is charged from the day your loan starts and will only be cancelled if you pay off the amount of credit advanced within the Pay in 4 Period.

Why choose Snap?

- Loans available from £250 - £4,500

- Check your eligibility without affecting your credit score.

Please note: A hard credit search will be required at point of completion of your loan. - Snap will tell you how much you can borrow instantly

- Help and support will always be available via phone, email or SMS

- Get access to the best products and fair prices

- Join the thousands of customers already using Snap Finance

- Snap are highly rated on Trustpilot

- Your finances are in safe hands. We are authorised & regulated by the Financial Conduct authority with Reference Number 741813

How do I qualify to apply for Snap Finance?

Snap have helped thousands of customers get what they need. They want to help you choose a finance option that suits you. To apply, they just ask that you:

- Over 18 years of age

- £200+ income per week

- Valid bank account to set up a direct debit

- Deposit paid by credit or debit card

- UK resident

Why choose Snap?

- Loans available from £250 - £4,500

- Check your eligibility without affecting your credit score.

Please note: A hard credit search will be required at point of completion of your loan. - Snap will tell you how much you can borrow instantly

- Help and support will always be available via phone, email or SMS

- Get access to the best products and fair prices

- Join the thousands of customers already using Snap Finance

- Snap are highly rated on Trustpilot

- Your finances are in safe hands. We are authorised & regulated by the Financial Conduct authority with Reference Number 741813

How do I qualify to apply for Snap Finance?

Snap have helped thousands of customers get what they need. They want to help you choose a finance option that suits you. To apply, they just ask that you:

- Over 18 years of age

- £200+ income per week

- Valid bank account to set up a direct debit

- Deposit paid by credit or debit card

- UK resident

Representative Example: Cost of Goods £1200, Deposit £50, Amount of Credit £1,150, Annual Fixed Interest Rate 34.04%, Monthly Payment £51.75, Term 36 months, Total Payable £1913.00, Representative 39.9% APR.

HOB (Manchester) Ltd trading as HOB Manchester is an Appointed Representative of Snap Finance Ltd which is authorised and regulated by the Financial Conduct Authority (Firm reference number 741813). Snap Finance Ltd act as the lender.

Credit subject to status. Terms and conditions apply.

Snap Finance Ltd is a company registered in England and Wales. Company Number 08080202 Registered address: Snap Finance Ltd, 1 Vincent Avenue, Crownhill, Milton Keynes, MK8 0AB